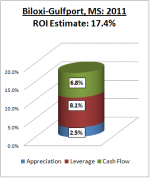

Biloxi/Gulfport, MS: 17.4% Return on Investment (2011)

Biloxi/Gulfport, MS: 17.4% Return on Investment (2011)

With the “Go Zone” tax advantages extended into 2010, the Biloxi / Gulfport market experienced greater stability than many other similar market areas. The distinct advantage offered by investment in the “Go Zone” is the ability for qualified investors to recognize 50% of the total allowed depreciation in the first year of ownership. The BP oil spill in the Gulf of Mexico proved to be quite challenging for the region, but Biloxi is pulling through the difficulty admirably. Currently, approximately 29% of listings are from foreclosures[1].

The fundamental economics of Biloxi/Gulfport remain strong, driven by a robust gaming industry anchored by multiple large casinos and a seaport on the Gulf of Mexico. Investors can realize attractive cash flows to finance the expenses and mortga

ge payments for the property. Investors looking at Biloxi/Gulfport should be careful to ensure that the property they purchase is a quality structure at a good location. When the “Go Zone” tax benefits were announced, many people rushed into the Gulf Coast area, and some were burned with low quality deals. The BP oil spill in the Gulf of Mexico has introduced some volatility into the values for Biloxi and Gulf Port. However, this volatility has been relatively mild and is expected to level out into modes value appreciation during 2011.

As the “Go Zone” tax benefits expire, we expect to see investment activity in Biloxi decrease relative to recent years. It is possible that the trough of this investment decline could represent a secondary buying opportunity if the lower volume of purchases suppresses prices relative to rents. Our models indicate that the economic fundamentals of Biloxi and Gulfport are likely to remain strong.