Jason interviews Robert R. Prechter, Jr., CMT, President of Elliott Wave International (EWI), the world’s largest market forecasting firm.

Jason interviews Robert R. Prechter, Jr., CMT, President of Elliott Wave International (EWI), the world’s largest market forecasting firm.

EWI’s 20-plus analysts provide around-the-clock forecasts of every major market in the world via the internet and proprietary web systems like Reuters and Bloomberg. Mr. Prechter began his professional career in 1975 as a Technical Market Specialist with the Merrill Lynch Market. He has been publishing The Elliott Wave Theorist since 1979. He is also Executive Director of the Socionomics Institute, a research group. Mr. Prechter has won numerous awards for market timing, including the United States Trading Championship, and in 1989 was awarded the “Guru of the Decade” title by Financial News Network (now CNBC).

He has been named “one of the premier timers in stock market history” by Timer Digest, “the champion market forecaster” by Fortune magazine, “the world leader in Elliott Wave interpretation” by The Securities Institute, and “the nation’s foremost proponent of the Elliott Wave method of forecasting” by The New York Times. Narrator: Welcome to the American Monetary Association’s podcast. Where we explore how monetary policy impacts the real lives of real people, and the action steps necessary to preserve wealth and enhance one’s lifestyle.

Jason Hartman: Welcome to the podcast for The American Monetary Association.

This is your host, Jason Hartman and this is a service of my private foundation, The Jason Hartman Foundation. Today we have a great interview for you, so I think you’ll enjoy it. And comment on our website or our blog post. We have a lot of resources there for you, and you can find that at AmericanMonetaryAssociation.org or the website for the foundation which is JasonHartmanFoundation.org. Thanks so much for listening and please visit our website and enjoy our extensive blog and other resources there.

Start of Interview with Bob Prechter

Jason Hartman: It’s my pleasure to welcome Bob Prechter to the show. As I mentioned before, Bob is the president of Elliott Wave International and he has a long standing career, and some excellent insights into markets. The Elliott Wave principle is a form of technical analysis that basically attempts to forecast trends in financial markets and other activities. It was developed in the 30s by Ralph Nelson Elliott. And he was an accountant who basically developed this theory that has a lot of support and a lot of backing to it. I think you’ll really enjoy this interview. It’s really insightful, and what’s especially interesting is the stuff where we don’t talk about money necessarily, but we talk about socionomics and social trends.

So let’s listen in and enjoy the interview, and we will see you very soon for show number 80. I want to welcome Robert Prechter to the show. He’s from Elliott Wave, and he’s from Atlanta, Georgia. And bob, it’s great to have you on the show.

Bob Prechter: Well thanks for having me.

Jason Hartman: Good. Tell us a little bit about your background, and then I want to get into Elliott Wave Theory and talk about your book.

Bob Prechter: Well I started on Wall St in 1975 and I went to work for Bob Farrell who ran the technical department at Merrill Lynch in New York City. I stayed there three and a half years, was completely itching to get out on my own, but I learned a lot there. It was a great place to be, and particularly New York City because that was the only place that I could find a copy of R.N. Elliott’s original writings. And he’s the guy who originally wrote two books on what he called The Wave principle, and what some other people today call Elliott’s Wave Principle. And they were in the New York Public Library on microfilm, and that really got me started. Because there was so much there that people weren’t talking about. So much in the way of detail and a completely thought out model of how stock market behaves and financial markets in general behave. That was the treasure trove that got me started. I met a man named A.J. Frost who was from Canada, and his partner Hamilton Bolton that kept the wave principle alive in the 50s and 60s. And in 1978 we wrote a book together. That was back when the DOW was at triple digits, if anyone can remember that. And we were saying this is a tremendous buying opportunity. We’re finishing a long sideways bare period. We’re calling it the fourth wave, that four and five wave up move. So there’s a big bull market coming. And we were very aggressive in calling for the market to get as high as three or four thousand. And it turned out it actually tripled from there.

Jason Hartman: Oh wow, who knew? That was a very sage prediction.

Bob Prechter: Well, somewhat but I have to tell everybody, we make mistakes too. During the 90s I thought that things were way overdone. I got bearish early. But I’d rather be out early than try to get out too late.

Jason Hartman: A lot of people are probably echoing that sentiment right now I would assume. Including the person you’re talking to, actually.

Bob Prechter: Yeah, well everybody’s experienced some difficulties I think.

Jason Hartman: Yeah, no question about it. Tell us how Elliott Wave Theory works, and what is so special about it. What does a Elliott Wave theorist do as they’re looking at markets?

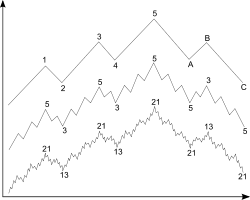

Bob Prechter: Well the Wave Principle is a model. It says that the stock market is, to use a fancy term, an iterated hierarchical fractal. What that means is there is an essential pattern or a wave structure that appears at all degrees of trend, whether you’re watching a daily chart, a weekly, a monthly, a yearly and so on. The smaller patterns add together to create larger patterns with essentially the same basic shape. We didn’t know the word fractal when R.N. Elliott came up with this in the late 30s and early 40s. But since then we’ve coined that word. Mandelbrot coined that word, wrote a book about it. And apparently, as he has shown, there are fractals throughout nature and we think that this is an engine of social behavior and human beings. When human beings interact with each other they share their emotional states, we call it social mood. It seems to go through stages from extreme pessimism to optimism and back again. And those show up as buying and selling on the New York Stock Exchange. They also show up in other areas such as what clothes people choose to wear, and how high women’s hemlines are and how much production is going on in the economy. So it just effects everything.

Jason Hartman: Yeah, I’ve heard the jokes about that. When the dresses get shorter, that means a bull market is coming, when the dresses get longer a bear market is coming.

Bob Prechter: Well actually it’s a coincident indicator, so the higher the market goes generally the higher the hemlines, and the lower it goes the lower the hemlines. So when they get to extreme levels, that’s when you start saying well that’s a useful indicator. We must be near bottom or top. So it’s sort of frivolous but there’s some truth to why that happens.

Jason Hartman: Really? That’s amazing. So, how does it differ from other theories? There are so many theories on markets, and especially the stock market. Technical analysis, fundamental analysis, charting. This is all along sort of the charting lines. Is that correct?

Bob Prechter: Well, it differs from all of the theories because it’s the only form based model theory of the stock market. There aren’t any others. Among academics there are some currently popular models that evolve from the random walk model. Now that was the only other one that was a form based model. It says basically, there is no form. Prices just wander around. And since then, there have been statistical studies showing that in fact, the stock market does have what is called stylized statistical facts. Which means for example, big moves happen more often than they would in a bell curve. They call these stat tales. There’s also, volatility tends to cluster. When the market gets volatile it tends to stay that way for a while, and when it gets calm is tends to stay that way for a while. Random walks don’t do that. So what they are doing now is trying to use statistics to modify the random walk. If it was not completely random, we found these events. But those are statistical models. They’re not form models. And the wave principle model actually has all the same statistics that the stock market does when you apply or when you test them for these various statistical facts. That’s a very cool thing because it tells us that our model is very close to what’s really going on in the stock market.

Jason Hartman: So what is the model telling us now?

Bob Prechter: Well, one of the interesting things about the wave principle model is even in discussing it you almost cannot help but put out a forecast, because when you’re explaining the form, you show it, and it’s rarely complete on that day. It’s usually in progress somewhere. And that’s what we did in our 1978 book Elliott Wave Principle. We said we’re finishing the fourth wave and we’re going to have a giant fifth wave on the upside. Well, I wrote this book Conquer the Crash in 2002 because that fifth wave finally ended in the first quarter of 2000, and we’ve been in a bear market ever since. And we had the first wave damage. We called it A wave, ending in 2002. That was a 50% hit in S & P prices. And then there was a big recovery in the middle. Sometimes those recoveries are small, sometimes they can actually carry nominal prices to new highs. Now, real prices got nowhere near new highs. It’s been a bear market ever since 1999 in real value of stock shares. But now we’re in the difficult part. The part where there’s no place to hide the cash, it’s called Wave C and it’s not over yet.

Jason Hartman: So how long is that wave going to persist? I do believe we’re in a deflationary segment now, although I think we’re going to disagree on this, I believe we’re going to see inflation coming in the next couple of years. It’s going to be fairly significant. Like, I just finished interviewing Chris Martenson who you may or may not know. He has a very popular course on the internet called The Crash Course. And it’s every guest I talk to on this show is talking about the creation of money that is just… if you look at the adjusted monetary base, the stats that the fed puts out, this has never before happened in history. Now credit is contracted, and so I think that’s why we’re seeing deflation right now, but when credit comes back as I think it will slowly and cautiously, and I think that’s a good thing. Because it was obviously stupid before how it was so rampant. Aren’t we going to have inflation? When you put money supply with credit supply, and those two equal inflation or deflation. And right now we’ve got massive increase in money supply, contraction in credit supply, and so the net effect there, the aggregate of the two is deflation. Bob Prechter: Well you’re the first person to interview me that understands that.

Jason Hartman: Oh, really? Wow. I’m not even an economist, but then again Al Gore is not a scientist either, so…

Bob Prechter: That’s right, and if you’re not an economist you don’t have to unlearn so much material.

Jason Hartman: Well okay, fair enough. I don’t have any bad habits yet, huh Bob?

Bob Prechter: That’s exactly right. Well, we agree on some things, but there are nuances that I think are crucial here. In Conquer the Crash, I said they’re going to try to fight this with inflationary measures. We already knew that from Bernanke and I said it’s going to fail. And so far it’s failing in spades.

Jason Hartman: Oh it’s miserable.

Bob Prechter: Stocks are down 45%, commodities are down 60%, property is down 40%, in some areas it’s even worse. The liquidity is drying up. The over-supply is huge. And as you say, the fed is doing everything it can to monetize crummy debt like mortgages and stuff like that. They’ve doubled their balance sheet. But the fed alone can’t do it because once people realize that the balance sheet stinks, their credibility and their own credit is going to really be going downhill. What Bernanke has managed to do, which goes further along your point, he’s going to congress to get congress to print even more fresh treasury bills so they can monetize even more debt. And he wants them to shore up 700 billion dollars’ worth of this, and 500 billion dollars’ worth of that. There are people on the web that have looked at all of the spending that has already occurred from the FDIC, the Federal Reserve, and the Treasury. And it now tops three trillion dollars, and the total amount pledged is 8.7 trillion. So only one third of the pledge spending has been done. But here’s the problem: When the Fed takes mortgages from a bank, it still expects that bank eventually to take the mortgages back. Some people say, well it never needs to do that. And that’s true technically. But the fed really doesn’t want to get stuck with all of this stuff. They keep telling us that the government is going to make money on their stock purchases, which is a joke. They’re already down a third on all those stock shares they bought. The fed’s not going to make any money on this, and at some point people are going to realize that. But the bottom line is so far, as you’ve pointed out, as fast as they’re trying to create new money, the credit is collapsing faster than that. And we have so much credit. The whole system is saturated with credit. Banks have loaned out every dime of their deposits. It’s all owed. Almost everything that’s considered an asset today is an IOU. And I don’t think that the congress ultimately has the backbone to inflate. And as I explained in the book, even if it does and even if the fed said we’re going to literally turn on the press and have greenbacks pouring out the other end, what would happen to the bond market? It would crash. Everybody says, okay they’re going to pull a Germany on us. And go into currency hyperinflation.

Jason Hartman: So you’re referring to Weimar Republic, just for the listeners.

Bob Prechter: Yeah, sorry. In 1923. If they took that route, all of the credit instruments would instantly collapse. You’d still end up with deflation. And today they have not done that. They have not turned on the greenback printing press. So it’s a fascinating time in history. It’s never been done before at this degree, but so far everything we’ve said is happening. They have had no net result on the stock market or the real estate market at all. I agree with you. Just one last comment: I do agree that when we’ve gotten rid of the entire market for credit and the debts are all wiped out, I think they’ll probably turn to hyperinflationary policy.

Jason Hartman: Any particular time frame?

Bob Prechter: Yeah. The earliest I think the collapse could be done, would be about two years from today. That’s based on looking at the 1929-32 experience which was a little less than three years, and the post South Sea bubble collapse, which was a little over two years. That was in 1720 to 1722. However, just as it happened in Japan, the government is trying to get in the way of the collapse. And in doing so all they’re doing is prolonging it and ultimately making it worse, which is what they do.

Jason Hartman: I couldn’t agree more, by the way with that. I think if the government would just get out of the way, we’d take our medicine, it would taste bad and we’d get through it a lot faster. But they’re just prolonging. It’s just going to be a long, achy prolonged mess if the government doesn’t get out of the way. Which, they’re not going to get out of the way.

Bob Prechter: Which they won’t! Every week is another grandiose plan for more inflation and meddling. And not only that, they’re talking about appointing for example, a Car Czar. Give me a break. If General Motors can’t make it building cars and trying to follow the consumer taste, I certainly can’t imagine some government appointee figuring it all out and making all three of those car companies profitable. It’s just a joke.

Jason Hartman: You’re absolutely right. I was listening to Rush Limbaugh this morning, I happened to catch him, and he was talking about how the people in the government that are trying to solve all the problems have never produced a car, most of them have never run a business, they’ve never drilled and found a drop of oil, they’ve never done anything.

Bob Prechter: Well, they’ve printed money. So I guess if they’re going to throw dollars at them, tax payer dollars, or savers value, that’s still a sad thing.

Jason Hartman: All they know how to do is make laws. They know how to legislate, they know how to regulate, and they don’t know economics, they don’t know business. There are exceptions of course, but I’m just making a generalization. It’s just unbelievable that…

Bob Prechter: We all have to be humble in that regard. I recently was one of I think about a dozen speakers talking to the Georgia legislature, one of their subcommittees about the real estate problems, and one of the things I said was when you let the free market go, nobody here including myself is smart enough to know how it’s going to do what it’s going to do. For example, when Judge Green took away the AT&T monopoly in 1985, did anybody know in advance that we would have cellphones, that you could download movies onto your phone? That you could be on the top of a mountain in Chile and talk to some friend of yours two thousand miles away, or have the internet? And all of the wonderfulness that that’s brought, the fact that you can go on there and get the knowledge of the world at your fingertips in seconds?

Jason Hartman: For free most of the time?

Bob Prechter: Yeah, letting the car companies go down is a great thing. Because if the free market is allowed to operate, we’ll have better cars, made by smarter people that get 100 miles a gallon or use some alternative energy, you just don’t know. But we do know that trying to bail them out is a terrible idea.

Jason Hartman: Well just to state my side, I do agree with you. My only proviso on that is that I hate to see sort of the last bastion of American manufacturing go away. Bob Prechter: Yeah, I totally agree. But you know one reason it’s gone? Because they bailed out Chrysler in 1979. Jason Hartman: How’s that?

Bob Prechter: Had they let Chrysler go under, it would have only been GM and Ford.

Jason Hartman: Right…

Bob Prechter: And they would have shared the marketplace and had that much better income, and a better base from which to try to compete with Japan. Maybe one of them would have survived this.

Jason Hartman: Oh, okay. Interesting. Well tell us about the book Conquer the Crash. I just ordered it as I was talking to you here, and I’m sorry to say I’m not up on your book, but what is it telling people to do? What is your advice and what are your predictions?

Bob Prechter: Well, first of all a year ago you could have gotten that for about two bucks used on Amazon.

Jason Hartman: But the supply has dwindled because of the state of the economy?

Bob Prechter: It’s a little more expensive, but it’s still worth it. You can buy one for $10. I don’t even get the money, but that’s good.

Jason Hartman: Supply and demand.

Bob Prechter: Yeah, that’s true. Well, I think the book is unique. It’s the only bearish book that didn’t say put all your money in platinum and silver and gold, and foreign stocks, and foreign currencies. Because I said very clearly what you want. You don’t want to buy any investments. No real estate, no corporate bonds, no municipal bonds, no stocks, and no commodities. You want to hold on to your cash. I was a little bit early, but that’s all coming true now.

Jason Hartman: Okay, so your favorite investment vehicle then is cash?

Bob Prechter: Yeah, cash. That’s a slippery word. Some people think that money market funds hold cash and they don’t. They hold a lot of IOUs, and are those IOUs any good? The closest thing to cash we have in our fiat money system besides actual greenbacks, and I do favor you having some of those in the house in case your bank closes, but the second best thing to own or the closest thing to cash are US Government Treasury Bills. And they returned a nice return in the last couple years. Of course, now they return absolute zero.

Jason Hartman: Because there’s so much demand for them as people are afraid to be in anything else. Is that why?

Bob Prechter: Precisely right. And I also recommended the short term bills of some other governments. And they worked well up until recent months, and that was Swiss money market claims, and debt of the New Zealand Government in Singapore. Those, we think are pretty strong relatively speaking, that is compared to the rest of the world. So a little bit of diversification in those cash equivalents and you could just wait because you’re going to be able to buy ten times the stock shares, ten times the property and all the defaulted bond paper you want in about somewhere this decade.

Jason Hartman: The interesting thing about hat strategy is, I’m definitely bearish on the US dollar and bearish on cash. So we’re going to have our differences of opinion there, but right now at this moment, I am bullish on that. And I never, ever thought I would say this Bob, but I have a friend who is just this ultra-conservative guy, he’s a doctor. His name is John and we was always, year ago, looking for the best deal on CDs and what CD paid the highest rates. And I tell you, if I could get 3% on my money this last year, other than my property investments which are leveraged, then those have a whole different set of dynamics that I’ve gone into on the show, but they’re too long to talk about here right now. That would have been… I would have been jumping for joy. And I’ve heard Doug Fabian talk about it. He says, just like you, don’t forget that cash, that a CD or money market is actually an investment. And right now, in the past year you’re right. And maybe for the next year or so, I’m pretty sure you’re going to be right too. But beyond that, I’m really bearish on the dollar, and I think anything denominated in dollars is really going to be destroyed in value. You talk me out of that, if you would.

Bob Prechter: Well, here’s the irony: the reason the dollar is going up and will probably continue to go up for at least another couple of years, is that it’s so pitiful. Now let me say what I mean by that. The dollar is the most credit inflated currency on the face of the earth.

Jason Hartman: It is disgusting.

Bob Prechter: It’s disgusting. And as we know, it has been deflated to about four cents relative to its value prior to the creation of the Federal Reserve.

Jason Hartman: So 1913 to now, a dollar in 1913 is worth four cents today?

Bob Prechter: Exactly. Now, that’s mostly due to credit creation. So we have the biggest sea of IOUs in the world are denominated in dollars. And IOUs are what are collapsing. So the reason the dollar is strong is because we’ve been so profligate in creating all these dollar based IOUs, it’s deflating more than any other currency. And that’s going to continue because of the ocean of dollar denominated debt. I think we’re going to take back a lot of that inflation because most of it was credit. Now the fed, as you’ve pointed out is feverishly working to counter that. But at some point I think it’s going to be politically unfeasible and that the voters are going to tell them to stop bailing people out. That’s the thing they never count on. It’s like when we went into Iraq. And we said oh don’t worry, everybody will cheer and it will be over in three days. They never think about actual human behavior and what their actions are going to create in terms of blowback. Well here, we have a period that we’re in of increasingly negative social mood. And that makes people angry, it makes them fearful, it makes them more conservative with their money. And they’re not going to put up with the government bailing everybody on the face of the earth out. Pretty soon they’re going to hear from the voters and the congressmen are finally going to be in session telling each other we can’t do this or I won’t get re-elected. So the pressures are just huge, and I think deflation is going to win no matter what they do.

Jason Hartman: Conceptually I understand what you’re saying and the equation for deflation or inflation is money supply + credit supply, then you can measure… well they’ve made that much tougher and manipulated that too, but we used to have M3. And you can try to measure the money supply.

Bob Prechter: Try is the key word. Nobody can define money because we don’t have any money in our system. It’s all debt. Including the Federal Reserve notes. Even the cash in your wallet is an IOU. It’s an IOU nothing. We actually have no money in the system, and that’s why we have so many ends. Because people have to argue about, well which debt should we call money? It’s hilarious.

Jason Hartman: Alright. So if we had money in the system, if that were different, then what do you mean? What would we have? Would we have gold and silver?

Bob Prechter: Absolutely.

Jason Hartman: So just out of curiosity, do you believe in a gold standard?

Bob Prechter: No. But let’s be very clear. I believe in gold. Gold is money. And someday perhaps a thousand years from now or maybe even fewer, maybe 50 years from now. The free market might choose a different sort of money where people can have some sort of register that says I’ve done this amount of work and I’m registering this amount of work as a future buying ability. Who knows what the creative human mind will come up with? But a gold standard means I want the government to run the money and tell me it’s worth so many grains of gold, for example. Well we’ve already done that. The dollar started out defined, not as equal to gold, dollar meant a certain physical amount of gold. And the pound, as we all know, started out as a pound of silver. But did either of those hold their value? So a gold standard, a silver standard, the government will ruin any standard. If we returned to a gold standard it would just be another base from which they could rip off everybody, and that’s always the way it works.

Jason Hartman: Well, but not if it were 100% gold standard, or 100% silver standard right?

Bob Prechter: No, we had 100% gold standard in the United States up to 1933.

Jason Hartman: We didn’t have very much inflation either. That was very steady.

Bob Prechter: Exactly. You wouldn’t. Not with a gold standard, because the only way to inflate is to discover and dig up more gold.

Jason Hartman: Precisely. So, isn’t that a good thing?

Bob Prechter: No, because governments always renege. They always renege on the standard.

Jason Hartman: That’s because they can’t spend, they can’t discipline themselves. And the gold standard forces discipline.

Bob Prechter: No it doesn’t. Because all they have to do is abandon it. 1950 they created the fed, and we had a gold standard and they said, well no thanks. So my answer is get the government out of the money business. They have no business having anything to do with it. They can collect it in taxes, but money is simply a good and a service. It should be provided as everything that really matters to human beings should be provided by entrepreneurs and the free market. And all the bad money would go away, and there would be amazing ways to save and spend.

Jason Hartman: And it would reduce speculation and these stupid schemes that Wall St invents and that are invented in the market. But how do you do that? I don’t understand how you do that. Certainly I don’t think the fed should be controlling the money supply. I don’t like the government being able to print fiat money either. But then you say in the same breath, no gold standard. I don’t understand.

Bob Prechter: We let people provide a service of money so that you could have your money stored in a warehouse, and you get receipts for that. And of course you would trade with actual pieces of paper that said this is worth so much gold. But it’s provided by the market place. And there may be different ways that people would denominate these things. There is actually a prototype already in place. Have you ever heard of gold money?

Jason Hartman: Yes, I have. That’s a website, gold money.

Bob Prechter: Yeah well they have actual gold. It’s for real. It’s in a vault. And you can’t trade with your neighbor unless you have money that is gold in his system. But the government has nothing to do with it, and therefore I trust Jim Turk. I don’t trust congress.

Jason Hartman: Well I agree with you, but the government is attacking them. I have heard that the government has attacked all sorts of websites like this.

Bob Prechter: No, they attacked another one but not gold money. Gold money is run too well for that. Now, it could be that they’ll attack it anyway. That’s not an excuse for a gold standard, that’s an excuse for the government to leave people alone who are trying to provide a true money service.

Jason Hartman: The legal tender laws make it difficult to do that, right?

Bob Prechter: They make it impossible. We need to repeal those. Repeal the legal tender laws and get the government out of the money business just like we should get them out of the educational business and get them out of healthcare. They’re ruining, everywhere they step they ruin it and that’s certainly true with money.

Jason Hartman: I know, but unfortunately I don’t think either of us will get our wish.

Bob Prechter: I agree. Not in our lifetime.

Jason Hartman: It’s just the drift of politics is always to the left. It’s towards more government and bigger intervention. And that’s just the way things go until you have a revolution and things just fall apart and start over again. That sort of seems like the only way to correct.

Bob Prechter: That’s true. And even in Russia which was a total disaster for 70 years, it was total and complete ruin and bankruptcy that finally made the central planners give up.

Jason Hartman: Yeah, that’s for sure. Before we wrap up here Bob, I want to go back to that point you made about the Elliott Wave and it’s social interpretations and the long skirts and the short skirts, and the emotions and how people talk to each other, and the way that influences social life and markets. You’d mentioned that earlier right when we started today, and I found that very interesting. I’d love for you to just circle back on that if you would.

Bob Prechter: Yeah, I’d love to talk about that just for a moment. If anybody is interested in this idea, I have a two book set. It’s available on Amazon and it’s called Socionomics.

Jason Hartman: Socionomics. I’m going to look it up right now.

Bob Prechter: Okay, a colleague of mine Dr. Wayne Parker and I wrote a paper that was published in the Journal of Behavioral Finance, where we discussed some of the fundamental psychological differences between finance and economics. That’s one of the legs of this whole idea. But in essence, my hypothesis is that social mood is regulated according to the wave principle and is therefore independent of outside events. Outside events can make people emotional for brief periods but it doesn’t change the underlying fact that social mood is endogenously regulated. That means it’s got a life of its own. It’s the way people interact with each other. So we had these long waves. Some people call them cycles, but I think waves is a much more accurate term. For example, uptrends. When social mood is becoming more and more positive, many things happen as a result. People get more confident so they buy more stocks, and you start to see the stock market go up. They also get more confident in business. So a few months after the stock market turns up, you see the business numbers starting to improve. Politics tend to be less drastic. More encompassing and more middle of the road as people cooperate with each other in this period of feeling better. Peace treaties tend to come out well after a long term uptrend of many years or decades. When the trend turns downward and mood tends to get more negative, people get angrier, they get more fearful, they get more conservative, they get less tolerant of each other. And you get real consequences from this change in mood. You get people selling stocks. And as you know, from the top there’s never a reason the market is going down. People scratch their heads, why is this happening? That’s because it’s a mood they’re not aware of consciously, and there’s just a few people on the margin that start to sell their stocks. There’s other people that contracting their business plans or maybe contracting their borrowing or their lending. All of these actions have consequences. It also shows up in the taste for music. Popular music tends to be very happy and upbeat when the trend is up, and when it’s negative you tend to get depressing ballads, noisy A-tunnel music that’s popular and that sort of thing. It permeates every aspect of our lives, from economics to politics to pop culture.

Jason Hartman: What does it do to romance and marriage? I remember seeing all of the reports post 9-11 that marriages were spiking and everybody was kind of coupling up and getting married after 9-11. At the time, I had a pretty serious girlfriend, we didn’t end up getting married but I remember seeing that all over the news. That was a really rather big trend I think. I don’t know about the numbers but I heard about it a lot.

Bob Prechter: One of the trends that we’ve actually done the data search on, going back 90 years, is the rate of births as a percentage of the population, and also in arithmetic terms, tends to ebb and flow with the stock market. But oddly, it’s off by about a year when we have annual data. And we finally looked at it and realize all these lows coincide together if we just move it back a year. And then I realized well of course, what’s been regulated here with social mood trends is the rate of conceptions.

Jason Hartman: So you’ve got a nine month leg there obviously.

Bob Prechter: Yeah, exactly. And what happens is, a rising mood people tend to have more babies and in a falling mood people tend to have fewer. This goes back as far as we have the data. So people will say the demographics move the stock market and of course, we just like to joke and say well no, the stock market moves demographics. In other words, the social mood is making the stock market go up and down at the same time that it regulates how many children people decide to have. So it does really permeate every aspect of human interaction, but it’s happening at the unconscious level. People don’t know why they’re being compelled to do these things and feel these ways, but they do. And we think the wave principle tracks that. So when you learn the patterns of the wave principle, you have a pretty good handle on prediction. And Conquer the Crash and the previous book from 1978 are probably the two best examples I can give where we were way ahead of a multi decade move each direction I think, because this one is still young, in areas that other people just can’t even conceive. Because you have to study 300 years of history to see what’s about to happen.

Jason Hartman: That is really fascinating. So this book of yours, or this two book set, is called Socionomics: The Science and History of Social Prediction. Which by the way Bob, is out of stock on Amazon. There’s three new ones from different vendors and one collectible version. I suppose you autographed that one probably, right?

Bob Prechter: I don’t know, maybe.

Jason Hartman: And so that’s on there. And so just take on the Socionomics aspect, this point in history where we are now. This snapshot in time. People are obviously, there’s a downbeat mood. So what’s happening? Are marriages increasing? Are babies decreasing? Are you saying though on that thing that there are more births during optimistic times? Is that the trend?

Bob Prechter: It actually follows, even from the low and pessimistic times, it will rise along with the change in attitudes, yes and then begin to fall. As the market is heading into a peak.

Jason Hartman: So I’m just trying to know what’s going on now. If this theory is true…

Bob Prechter: Well if this theory is right we’ll see a decline in the birth rate.

Jason Hartman: Okay. So now, does this impact the fact that you’ve got longer skirts? So maybe there’s not as much pursuit going on.

Bob Prechter: There may be a connection to that. Every time people try to say well it’s due to this mechanical cause, we always step back and say no, it’s mood causing both. It’s causing the skirts to go down… And men are part of that decision too.

Jason Hartman: Sure, sure.

Bob Prechter: Whether to have a child, and they just probably feel like well I really don’t feel like having a kid. I just don’t feel good enough. I don’t want one. I don’t think they can explain it rationally. Although having children isn’t a rational decision. We don’t sit around and say, well the benefits of having a child are as follows. We just one day wake up and say alright it’s time, let’s have a kid.

Jason Hartman: Sure. That is really fascinating. I did not know we would diverge into the socionomics aspects of this when we were talking about Elliott Wave. But that really gives it a lot more color and flavor, so that’s very interesting. Anything you want to say in closing? We want to have all our listeners go get your books and so forth, but kind of sum this all up for us if you would.

Bob Prechter: Yeah, what I tell people is to get the full benefit of all the ideas we have here at Elliott Wave International, you really don’t even have to spend any money. Maybe buy one, two or three books. The two we talked about, Conquer the Crash actually has a couple pages in there about the wave principle. It explains it very concisely, and it talks for a page or two about the socionomic aspects of it. So even that one book can teach people a lot. But we also have a lot of free content on our website where we talk about the current news and how it fits into what we think. Only the people who really want to follow the markets closely have to pay for the services we provide to serious investors and traders and that sort of thing. So just come to www.elliottwave.com.

Jason Hartman: Good stuff. Well, Bob Prechter, thank you so much for being on the show. We appreciate having you.

Bob Prechter: Well it was a great interview. I really enjoyed taking the time.

Narrator: The American Monetary Association is a nonprofit venture funded by the Jason Hartman Foundation which is dedicated to educating people about the practical effects of monetary policy and government actions on inflation, deflation and personal freedom.

Our goal is to help people prosper in the midst of uncertain economic times. This show is produced by The Jason Hartman Foundation, all rights reserved. For publication rights and media interviews, please visit www.HartmanMedia.com or email media@HartmanMedia.com. Nothing on this show should be considered specific personal or professional advice. Please consult an appropriate professional if you require individualized advice. Opinions of guests are their own and the host is acting on behalf of The Jason Hartman Foundation exclusively.